You may also target a certain loan term or monthly payment by using our mortgage prepayment calculator. Using the $250,000 example above, enter "50" in the monthly principal prepayment field, then either hit "tab" or scroll down to click "calculate." Initial results will be displayed under "Payment details," and you can see further details in either the "Payment chart" or "Amortization schedule" tabs. Let's say, for example, you want to pay an extra $50 a month. The calculator allows you to enter a monthly, annual, bi-weekly or one-time amount for additional principal prepayment.To do so, click "+ Prepayment options." Now use the mortgage payment calculator to see how prepaying some of the principal saves money over time. Clicking the "+" sign next to a year reveals a month-by-month breakdown of your costs.Ĭlick "calculate" to get your monthly payment amount and an amortization schedule. To see this, click on "Payment chart" and mouse over any year.Ĭlicking on "Amortization schedule" reveals a display table of the total principal and interest paid in each year of the mortgage and your remaining principal balance at the end of each calendar year. For instance, in the first year of a 30-year, $250,000 mortgage with a fixed 5% interest rate, $12,416.24 of your payments goes toward interest, and only $3,688.41 goes towards your principal. Most of your mortgage loan payment will go toward interest in the early years of the loan, with a growing amount going toward the loan principal as the years go by - until finally almost all of your payment goes toward principal at the end. Your initial display will show you the monthly mortgage payment, total interest paid, breakout of principal and interest, and your mortgage payoff date. With HSH.com's mortgage payment calculator, you enter the features of your mortgage: amount of the principal loan balance, the interest rate, the home loan term, and the month and year the loan begins.

#MORTGAGE CALCULATOR NJ EXCEL HOW TO#

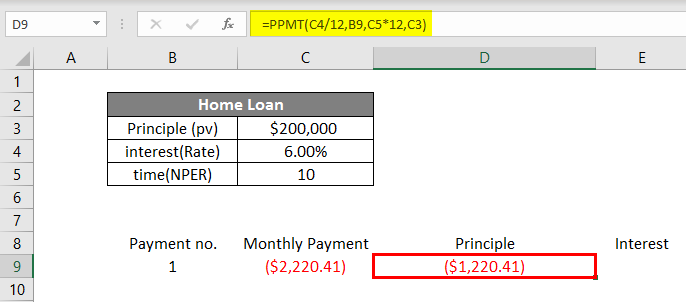

How to use the loan amortization calculator The loan calculator also lets you see how much you can save by prepaying some of the principal. The procedure for creating a similar Excel Mortgage Amortization Calculator is explained in detail on the Wikihow website.A mortgage amortization calculator shows how much of your monthly mortgage payment will go toward principal and interest over the life of your loan. The following date and financial functions have been used to produce the amortization schedule in the above Excel Mortgage Calculator: PMT functionĬalculates the regular scheduled payment amount.Ĭalculates the Principal part of the regular scheduled payment.Ĭalculates the Interest part of the regular scheduled payment.Ĭalculates the dates of the scheduled payments. Once this has been entered, the summary box on the top left of the spreadsheet will display the date of the final payment and the date of each of the scheduled payments will be displayed in the bottom half of the spreadsheet.įunctions Used in the Excel Mortgage Calculator Template If you want the spreadsheet to show the dates of each of the scheduled payments, you must also enter the loan start date into the user-input fields. Once you have entered these details, the summary table at the top-right of the spreadsheet will automatically display a summary of the mortgage payment details, and the mortgage amortization schedule will be displayed in the bottom half of the spreadsheet.

The details required are the loan amount, the interest rate, the number of years over which the loan is taken out, and the number of payments per year. In order to use the above Excel Mortgage Calculator, simply enter your mortgage details into the pink-shaded user-input fields (shown on the right above).

0 kommentar(er)

0 kommentar(er)